This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.

Crash Proof Retirement Donates $62,000 to National Liberty Museum

- October 3, 2019

- By: mstringer

- Press Releases

- 0 Comment

Phil Cannella, Joann Small, and Crash Proof Retirement COO Michael Stringer were on hand at the Philadelphia Downtown Marriott for the National Liberty Museum’s 20th Anniversary Glass Auction and Gala on Saturday September 14th to make a donation supporting the NLM and its Young Heroes Outreach Prog...

Read MoreCrash Proof Consumers Respond to NY Post Attack

- February 26, 2018

- By: Crash Proof Retirement

- Press Releases

- 0 Comment

This past week on The Crash Proof Retirement Show, we addressed an unfounded attack against First Senior Financial Group and The Crash Proof Retirement System. On February 15, New York Post columnist John Crudele attempted to assess the Crash Proof Retirement System through his “Dear John” column i...

Read MoreRegulatory Agencies Info

Intelligent Research for Consumers in Florida, Pennsylvania, New Jersey & Delaware. Verify your advisor at www.BrokerCheck.com Florida...

Read MoreWells Fargo Scandal

Wells Fargo has been hit with another major setback and it’s all due to the scandal that the banking giant has been embroiled in regarding millions of phony accounts. Philadelphia City Council has decided to get rid of Wells Fargo as its payroll supervisor of the city’s...

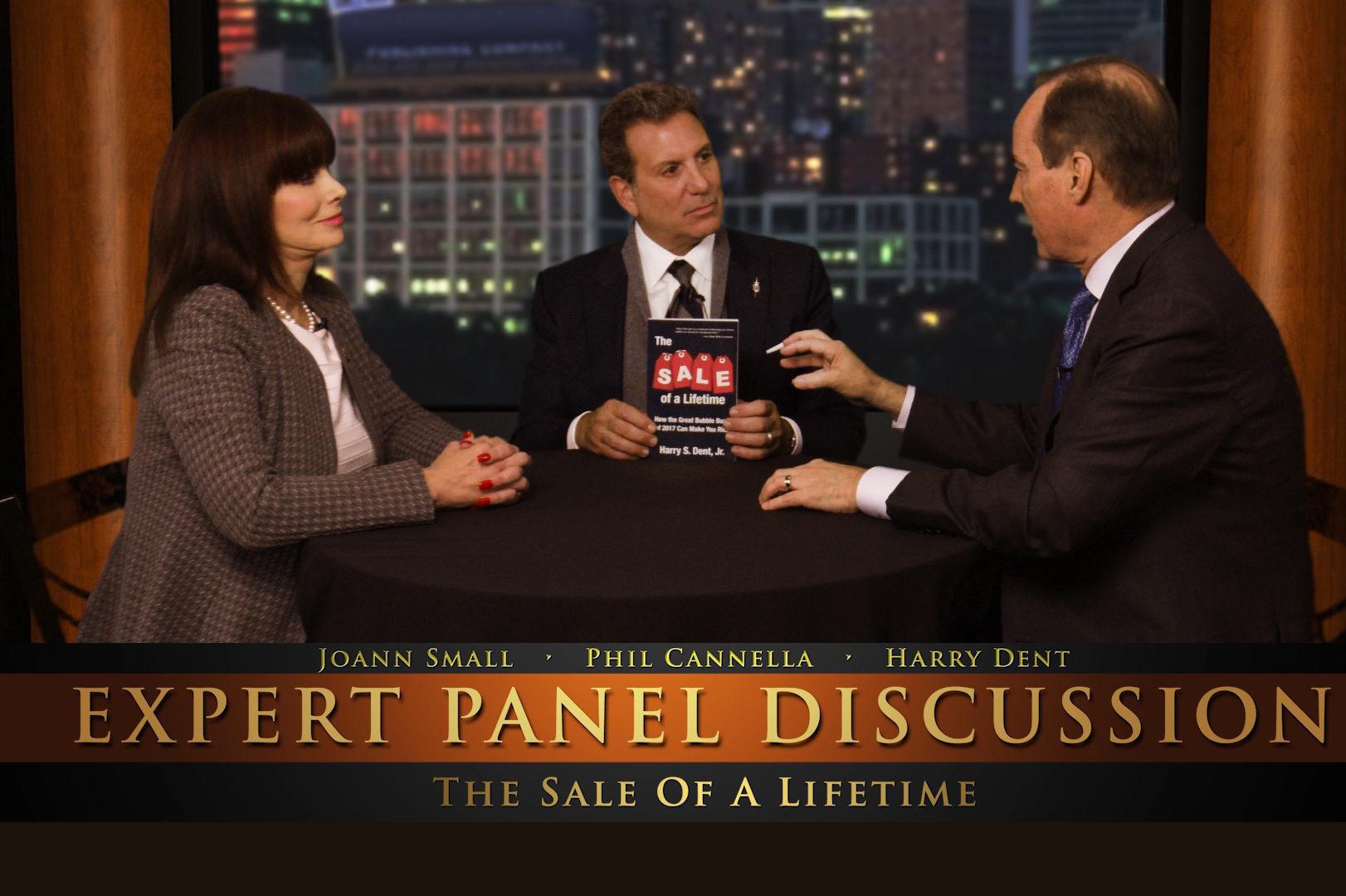

Read MoreInterview with Harry Dent

Watch Crash Proof Retirement’s Phil Cannella and Joann Small conduct another exclusive, groundbreaking interview with world famous economic forecaster Harry Dent. Afterwards, register for the next Crash Proof Educational Event on Tuesday, May 9th at Spring Mill Manor in Ivyland, PA....

Read MoreThe Sword of Truth

- May 1, 2017

- By: Crash Proof Retirement

- Blog

- 0 Comment

Trump’s Tax Plan

- April 27, 2017

- By: Crash Proof Retirement

- Blog

- 0 Comment

Calling it the "biggest tax cut in U.S. history" President Donald Trump wanted to make a huge splash when his administration announced his much anticipated tax plan yesterday, but the announcement may have created more questions than answers as it sent a slight r...

Read MoreStudent Loan Debt Problem

- April 13, 2017

- By: Crash Proof Retirement

- Blog

- 0 Comment

Economists and financial experts often talk about "bubbles". Debt bubbles…Economic bubbles…Foreign Currency bubbles. Now comes more evidence that the massive student loan college debt bubble is getting dangerously close to burst...

Read MoreToo Little Retirement Savings

- April 12, 2017

- By: Crash Proof Retirement

- Blog

- 0 Comment

Americans seems to be always complaining about money. Not having enough…not making enough…not saving enough. Now, a new survey conducted by Princeton Survey Research Associates, (a leading research institution) for Bankrate shows t...

Read MoreLife Settlement Companies

- April 11, 2017

- By: Crash Proof Retirement

- Blog

- 0 Comment

FINRA is the the Financial Industry Regulatory Authority, which is a private corporation that acts as a self-regulatory organization. As part of its responsibility to help consumers avoid being taken advantage of, FINRA has listed a numb...

Read More